Q2 2025 Lender Insights & Predictions

HomeLight’s Q2 2025 Lender Insights & Predictions Report compiles the findings of a survey of over 105 top lending companies across the United States, including The Loan Store, Fairway Independent Mortgage Corporation, Cross Country Mortgage, and more.

What's offered in the Lender Insights & Predictions Report?

- Lenders are bracing for a recession

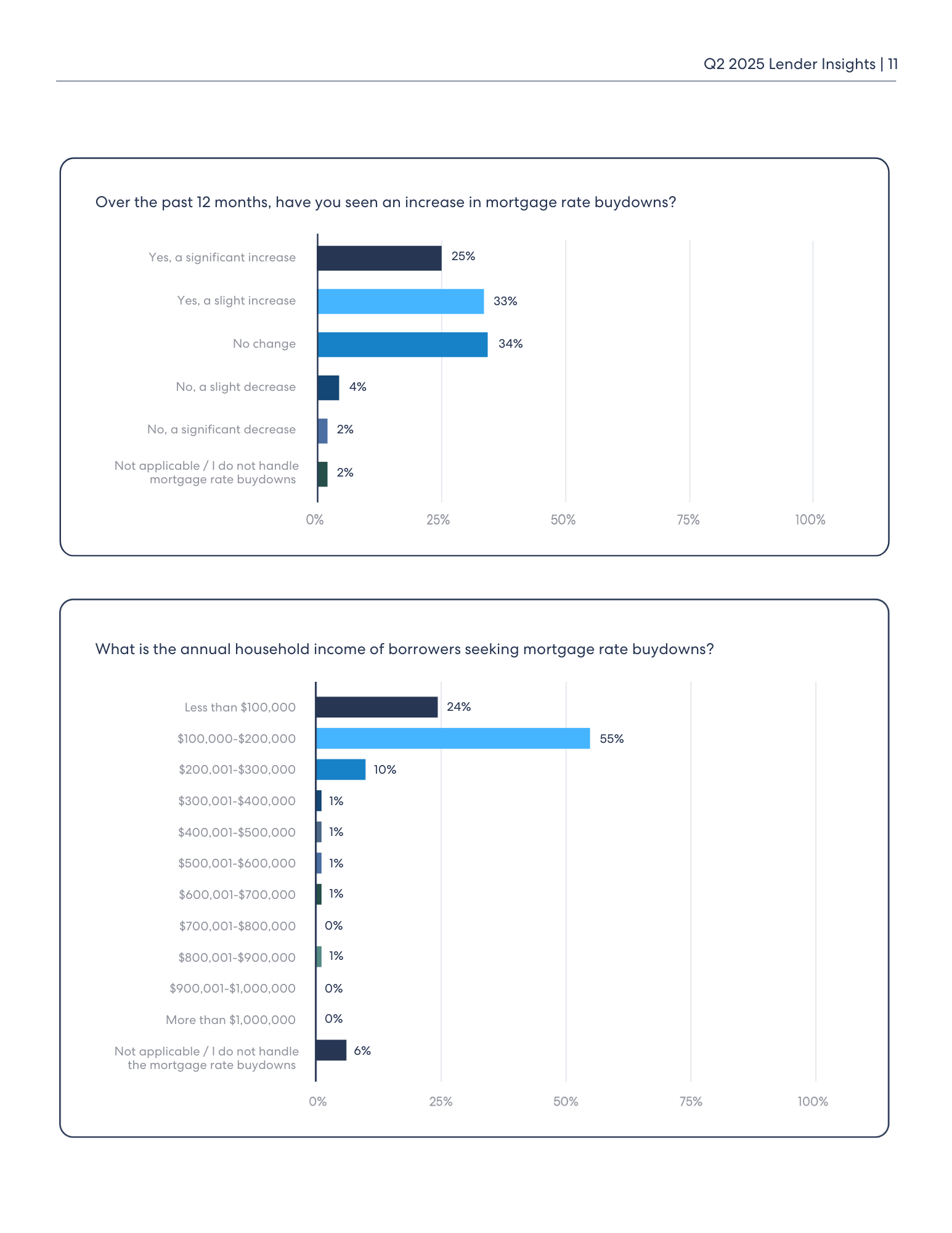

- Mortgage rate buydowns are on the rise…but not for everyone

- Seller concessions are helping buyers cross the finish line

- Deals aren’t making it out of the pipeline

- Tariffs threaten to worsen an already unstable market

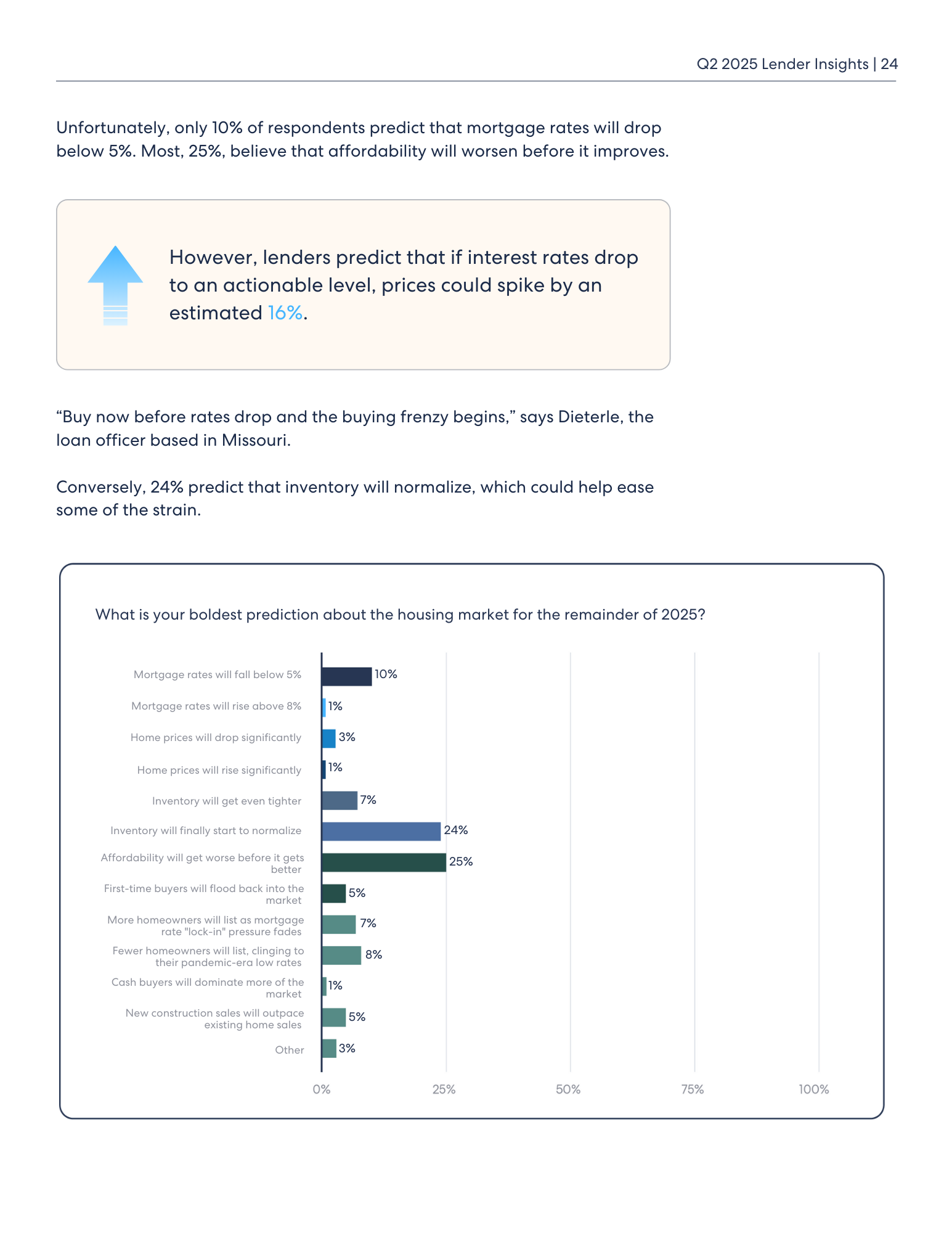

- Lenders urge: Buy now, before prices spiral out of control

- Buy Before You Sell programs: A light in the dark

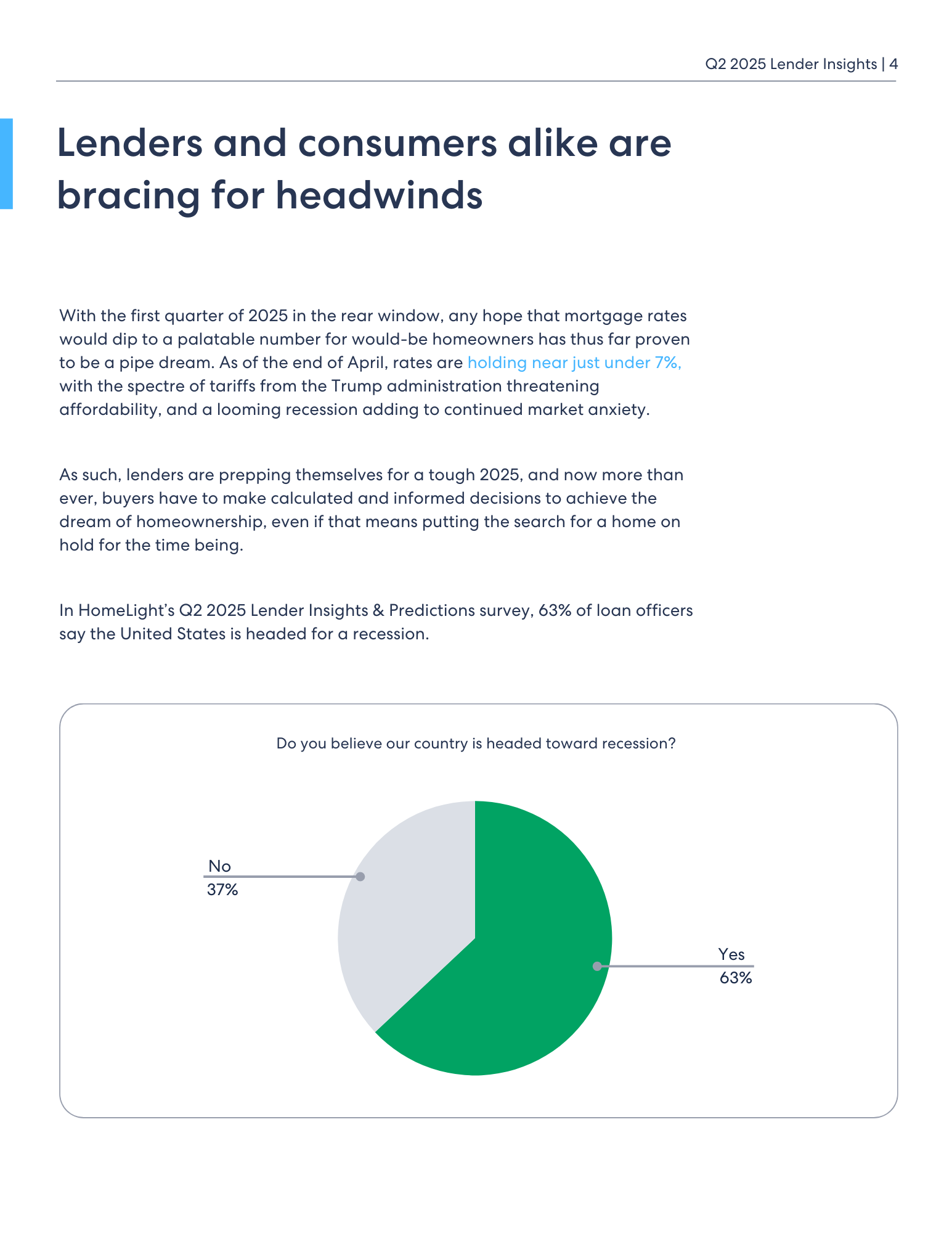

HomeLight’s Q2 2025 Lender Insights & Predictions survey was fielded between April 17 and 26, 2025. Our report shows that lenders are polarized over the potential impact of tariffs on home affordability, with most lenders convinced that a recession is imminent.

Meanwhile, as buyers struggle to cross the finish line, sellers are ramping up concessions to close deals.

We also explore the importance of buying a home now, as lenders believe that would-be buyers should take the plunge before homeownership becomes more difficult as market conditions worsen. Additionally, lenders stress the viability of Buy Before You Sell programs as a way forward.

Are you a lender? If so, are you interested in bringing the power of Buy Before You Sell to your clients?

Trusted by the nation’s leading real estate partners, Buy Before You Sell eliminates your client’s home sale contingency and reduces their DTI ratio in minutes. Get started today.

Explore additional articles and tools for buying or selling a home.

Visit our blog.

What Is an Interest Rate Buydown?

Learn how an interest rate buydown works, what it costs, and how it can benefit both buyers and sellers to lower mortgage payments in today’s market.

Read more

What is a Seller Credit? 4 Scenarios Where Credits Help Home Sales

A seller credit is money given to the buyer to help make the deal more attractive. Here’s how sellers benefit from it.

Read more

What Is a Buy Before You Sell Program? How to Make a Seamless Move

Explore the ease of buying a new home before selling your old one with our guide on Buy Before You Sell programs. Get expert tips for a seamless move.

Read more